Financial institutions globally are increasingly embracing the concept of open banking, changing business models, re-prioritizing investment strategies and building third-party partnerships that will drive innovation and customer experiences in the future.

The move away from products and services only being built and distributed by traditional financial institutions is gaining momentum, with the use of application programming interfaces (APIs) now seen as a secure and standardized method to provide consumers more control over how their data is used. This shift is transforming the dynamics of customer relationships, disrupting traditional banking business models forever.

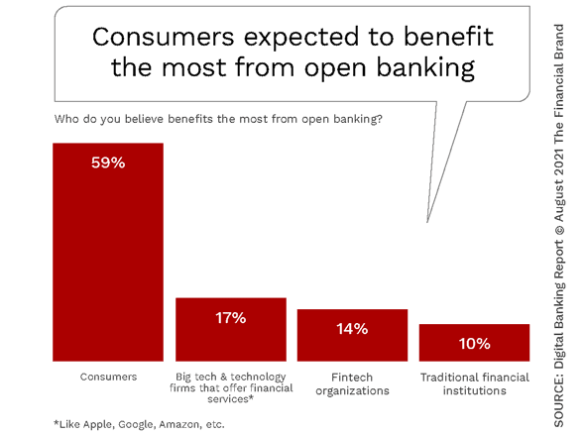

Open banking has become one of the major drivers of digital banking transformation, impacting technology and infrastructure investments, data modernization and decentralization strategies, fintech partnerships and even reskilling programs. The primary beneficiary of these efforts will be the consumer, according to research done by the Digital Banking Report.

Massive Opportunity:

Open banking provides traditional institutions an opportunity to increase efficiencies, improve the innovation process, enhance customer experiences and generate new revenue streams.

To prepare for this shift in the way banking will be done moving forward, banks and credit unions must determine the most appropriate business model that will meet their future business objectives. Then institutions must assess the capabilities required to deploy against the model selected and build partnerships with third party providers to make the strategy successful.

For some institutions, the decision may be to build a banking-as-a-platform (BaaP) model or a banking-as-a-service (Baas) model to open doors for selling products and services to an expanded prospect universe. Open banking also provides the opportunity to streamline and automate back-office processes, build a stronger innovation culture and improve customer retention.

Read More:

- Open Banking Provides Potential For Revenue Goldmine

- Open Banking Fintech Partnerships Required For Better CX

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Banks Increasingly Embracing Open Banking

The potential to use APIs to broaden relationships and improve the customer experiences has exploded over the past decade, with platform organizations such as Apple, Google, Amazon. Uber and Facebook using the model to grow exponentially and grab significant market share from established firms, including banks and credit unions.

But, you don’t have to be a tech giant to benefit from APIs — the opportunity is being leveraged in virtually every industry and by organizations of all sizes. In fact, small and midsize financial institutions that want to reach digital audiences beyond their existing geography or traditional product set can leverage open APIs. The options include creating an independent platform, partnering to jointly create a platform, or becoming part of another platform’s ecosystem. And there are many third-party solution providers who are willing to assist.

According to the Harvard Business Review, “Smaller firms could have an agility advantage by unbundling their capabilities, designing for their consumers, and exploiting opportunities in their respective ecosystems. The beauty of working with digital building blocks is that you don’t have to demolish the old factory and build a new one.”

Financial institutions are rapidly moving to develop their own response to open banking progress by fintech and other non-traditional financial institutions. While there are some model agreements in the marketplace, many large FIs have created their own data-sharing agreements, often based on Consumer Financial Protection Bureau (CFPB) principles, such as security, customer control, transparency, and privacy. (For more details about current open banking rules and regulations, see the white paper issued by the Federal Reserve Bank of Boston.)

A 2019 Deloitte survey showed that consumers seem receptive to open banking. One in five U.S. consumers expressed that they found open banking valuable, with more interest among Millennials (39%) and Gen X consumers (50%). Despite privacy and security concerns in the use of their personal information, consumers expressed interest in easier financial services and management, including the ability to compare bank services, integrate financial data and personalize budgeting tools.

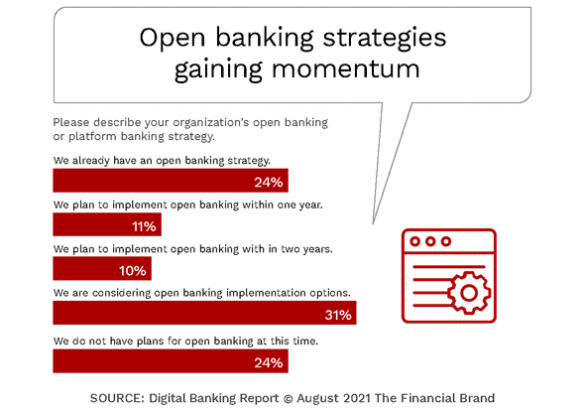

To build an open banking strategy, financial institutions will need to learn how they can work in this new world of ecosystems which requires a completely new way of dealing with customers, partners and traditional competitors. The good news is that the pandemic seems to have put a new energy into the desire to build such platforms. In our research, 24% of financial institutions already have an open banking strategy, with another 21% planning to implement an open banking strategy in the next two years. The fact that another 31% are considering an open banking option is also encouraging.

Not surprisingly, when we analyzed responses by asset size, the largest financial institutions (over $100 billion in assets) were the furthest along in their development of open banking strategies, with 32% stating they already had an open banking strategy and another 21% planning to implement an open banking strategy in the next year. Only 5% of megabanks did not have plans for open banking at this time. Midsized organizations ($10 billion to $100 billion) and the smallest organizations (under $10 billion) mirrored the banking industry as a whole when we looked at open banking maturity.

Biggest Banks Doubling Down on Open Banking:

Over 50% of megabanks (over $100 billion in assets) have either implemented an open banking strategy or will do so in the next 12 months.

Reasons for Adopting an Open Banking Strategy

While open banking is required in some regions, such as with the European Union’s Second Directive on Payment Services (PSD2) or California’s Consumer Privacy Act (CCPA), there are many other strong reasons for banks and credit unions to implement an open banking strategy. These include:

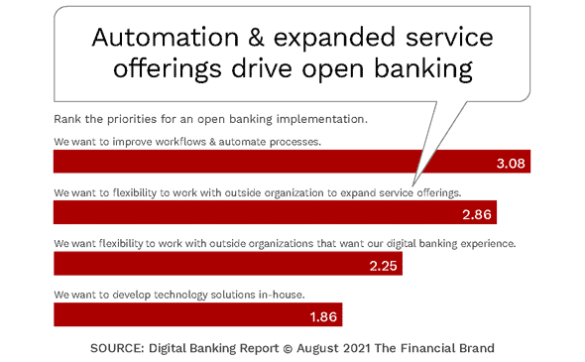

- Improved digital infrastructure that simplifies workflows and automates processes leading to increased efficiencies. This also enables data to be better used internally for enhanced customer experiences and increased customer lifetime value.

- Expanded service offerings that can create additional direct revenue streams. Open banking partnerships can also be used to create up-sells or cross-sells for other banking products.

- Third-party collaboration that leverages existing digital banking expertise to create unique value propositions that can generate new customers.

- Retention of relationships by providing solutions that make it less likely for customers to look for alternatives. This increases customer lifetime value, improving long-term profitability.

Transforming existing business models for a digital banking economy is not easy. Despite a growth in the development of open banking platform strategies, the maturity of open banking is still low. To make an impact, organizations must re-allocate capital and resources. When we asked organizations to rank the priorities for open banking implementation from 1-4 (with 4 being the top priority), there was a fairly uniform consistency that organizations were most interested in improving the back-office infrastructure and to expand product/service offerings.

Financial institutions need to be cautious on two different fronts. First, they need to avoid focusing only on finding economies through back office process improvement. The consumer experience can’t be ignored. Secondly, it’s easy to stick with what has worked in the past, waiting for the open banking trend to ‘go mainstream’. With change happening so quickly, being a ‘fast follower’ will likely result in lost opportunities.

The Need for Speed:

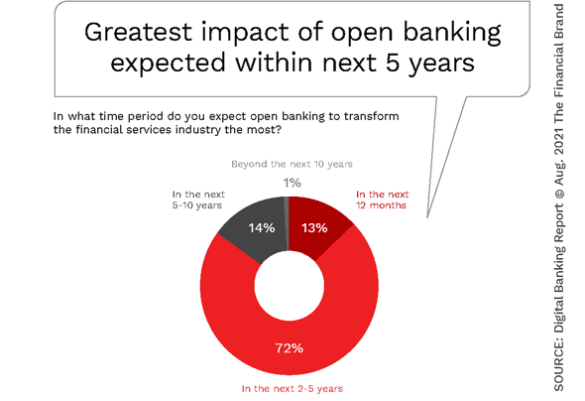

85% of financial institutions believe the greatest impact of open banking will occur in the next 5 years.

When we asked financial institutions globally about how quickly open banking will have a major impact on the industry, it was clear that time is not on the side of those slow to react. While only 13% of all respondents see open banking as having a significant impact on their business in the next 12 months, an additional 72% see the greatest impact between 2 and 5 years. Not surprisingly, the largest financial institutions were the most likely to see the impact the fastest.

Investment for the Future

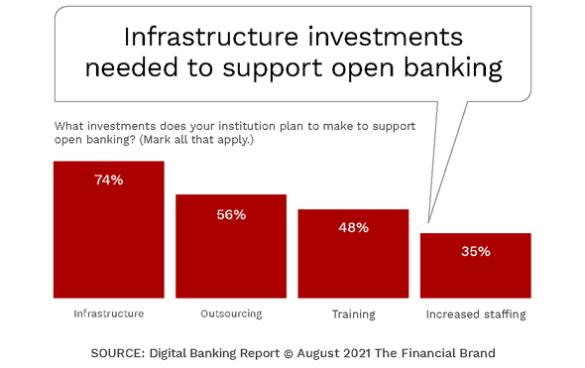

Incumbent banks and credit unions are investing heavily in all components of digital banking transformation as the largest financial institutions, technology giants, fintech firms and digital-only banks continue to gain market share. The investment in transformation strategies extends into making an organization more future-proof with open banking.

When we asked what investments were most important to support open banking strategies, almost three-quarters of organizations surveyed stated the need for increased investments in infrastructure, with over half also saying that outsourcing investments would be required. For organizations with assets in excess of $100B, the investment in infrastructure jumped to 94%, with those indicating an investment in outsourcing dropping to 47%.

Consumers Will be Primary Beneficiary of Open Banking

Consumers are increasingly demanding relevant, timely and personalized experiences that can save them time and money. The pandemic illustrated how well organizations in every industry could respond to the opportunity to bring technology and digital delivery together to meet consumer needs. In banking, traditional and non-traditional financial services providers can play an important role in creating open banking opportunities that can serve the institutions while also providing valuable customer experiences.

When we asked financial institutions globally who would benefit the most from open banking, an overwhelming percentage (59%) believed it will be the consumer. Far below that number were big tech and technology companies (17%), fintech organizations (14%) and traditional banks and credit unions (10%).

Open banking is part of the inevitable transformation to a platform economy. Every industry is experiencing this disruption at a pace never anticipated before the pandemic. It is no longer a question as to what will happen in the future, but what path each institution will take in the new open banking ecosystem.